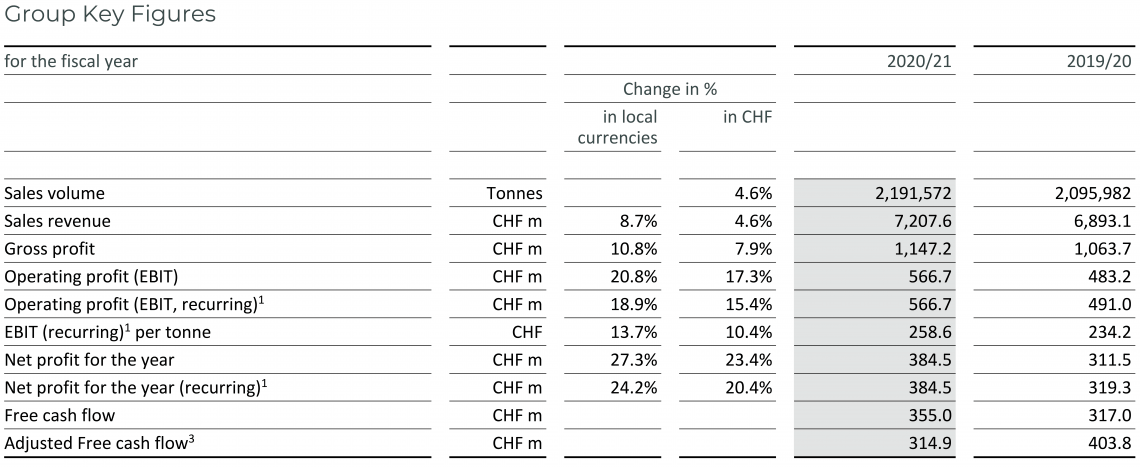

- Sales volume up +4.6%, all Regions and Key growth drivers contributed

- Sales revenue of CHF 7.2 billion, up +8.7% in local currencies (+4.6% in CHF)

- Operating profit (EBIT) up +18.9%1 in local currencies (+15.4%1 in CHF) to CHF 566.7 million

- Net profit up +24.2%1 in local currencies (+20.4%1 in CHF) to CHF 384.5 million

- Strong Free cash flow of CHF 355 million

- Confident on mid-term guidance2

- Antoine de Saint-Affrique proposed as new member of the Board of Directors

- Proposed dividend of CHF 28.00 per share, a payout ratio of 40%

1 Compared to prior-year Operating profit (EBIT) and Net profit recurring.

2 On average for the 3-year period 2020/21 to 2022/23: 5-7% volume growth and EBIT above volume growth in local currencies, barring any major unforeseeable events.

In fiscal year 2020/21, we have returned to our healthy growth path, with good profitability and strong Cash flow generation. Growth outpaced the underlying markets, with all Regions and Key growth drivers contributing to the good results. I want to thank all colleagues at Barry Callebaut for these results. They are living our corporate values and are the foundation of our success in the past 25 years.

Peter Boone, CEO of the Barry Callebaut Group

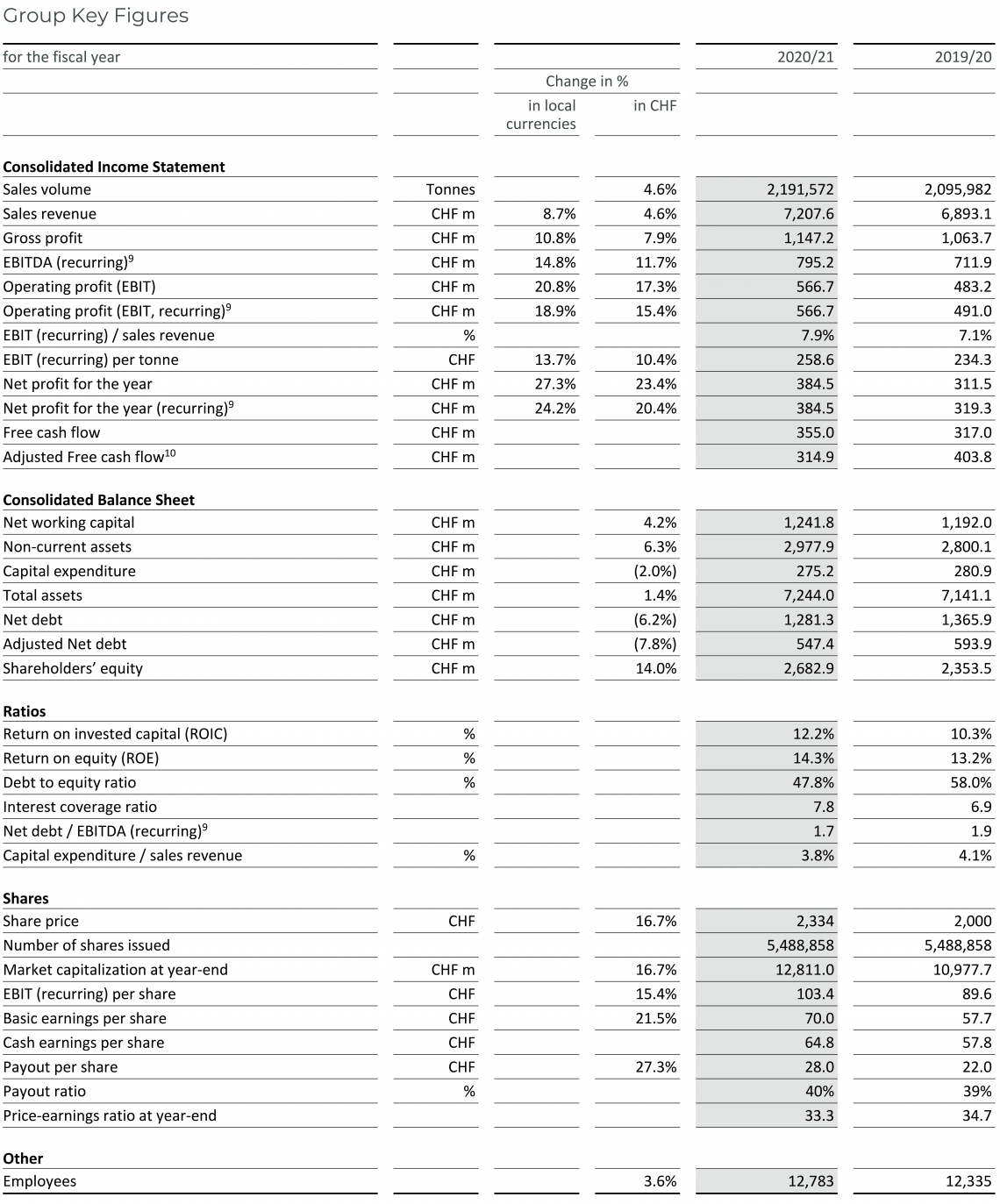

In fiscal year 2020/21 (ended August 31, 2021) the Barry Callebaut Group – the world’s leading manufacturer of high-quality chocolate and cocoa products, achieved healthy volume growth of +4.6% to 2,191,572 tonnes. The chocolate business surpassed the pre-COVID levels of 2018/19 and with a volume growth of +6.5% clearly outpaced the underlying global chocolate confectionery market (+1.8%)4. Volume growth was supported by all Regions (Asia Pacific +8.7%, Americas +7.9%, EMEA +5.5%) and all key growth drivers, Outsourcing (+4.5%), Emerging Markets (+9.7%) and a particularly strong performance of Gourmet & Specialties (+18.3%). Sales volume in Global Cocoa improved in the second half of the year, reducing the decline for the year under review to –2.6%.

Sales revenue increased by +8.7% in local currencies (+4.6% in CHF) to CHF 7,207.6 million.

Gross profit grew faster than sales volume and amounted to CHF 1,147.2 million, up +10.8% in local currencies (+7.9% in CHF) compared to prior year. The healthy volume growth, in particular in Gourmet & Specialties, had a positive impact on the mix.

Operating profit (EBIT) increased by +18.9%5 in local currencies (+15.4%5 in CHF) and amounted to CHF 566.7 million, impacted by a currency headwind of CHF –17 million. EBIT growth significantly exceeded the volume growth, supported by all Regions and a positive product and customer mix.

The Group’s EBIT per tonne improved to CHF 259, an increase of +13.7%5 in local currencies (+10.4%5 in CHF).

Net profit for the year grew by +24.2%5 in local currencies (+20.4%5 in CHF), compared to prior year, and amounted to CHF 384.5 million. The increase was based on the good EBIT growth and lower net finance costs of CHF –101.7 million. Income tax amounted to CHF –80.5 million in 2020/21, which corresponds to an effective tax rate of 17.3% (18.2% prior year).

Net working capital increased to CHF 1,241.8 million, compared to CHF 1,192.0 million in prior year. The increase was below the Group’s volume growth, thanks to good working capital management. The effect of receivables increasing in line with regained business momentum was largely offset by good inventory management and lower payables.

Strong Free cash flow generation continued and amounted to CHF 355.0 million, compared to CHF 317.0 million in prior year. Adjusted for the effect of cocoa beans considered as readily marketable inventories (RMI), the adjusted Free cash flow amounted to CHF 314.9 million, compared to CHF 403.8 million in prior year.

As a result, Net debt further decreased to CHF 1,281.3 million from CHF 1,365.9 million. Taking into consideration the cocoa bean inventories as readily marketable inventories (RMI), adjusted Net debt amounted to CHF 547.4 million, compared to CHF 593.9 million in prior year.

Outlook – On track to deliver on mid-term guidance

Smart growth will continue to be at the heart of our long-term strategy execution with a focus on returns and cash generation. By leveraging our global footprint, industry-best innovation, cost leadership, and impactful sustainability solutions, we are on track to accelerate up the value ladder. This makes us confident we will deliver on our mid-term guidance.

Peter Boone, CEO of the Barry Callebaut Group

Growing the world of chocolate and cocoa for 25 years

In 1996, Klaus Jacobs merged the Belgian chocolate maker Callebaut and the French chocolate maker Cacao Barry into Barry Callebaut. Since then, Barry Callebaut has positioned itself successfully as the heart and engine of the chocolate and cocoa industry, supported by the strong customer focus and the entrepreneurial spirit of its over 12,500 employees. For 25 years, Barry Callebaut has successfully generated long-term value in the cocoa and chocolate value chain for all its stakeholders, and will continue to do so in the future.

For more detailed insights into Barry Callebaut’s heritage, please see here.

3 Free cash flow adjusted for the cash flow impact of cocoa bean inventories regarded by the Group as readily marketable inventories (RMI).

4 Source: Nielsen volume growth excluding e-commerce – 25 countries, September 2020 to August 2021, data subject to adjustment to match Barry Callebaut’s reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

5 Compared to prior-year Operating Profit (EBIT) and Net profit recurring.

Strategic milestones

Expansion: In September 2021, Hershey and Barry Callebaut extended their strategic supply agreement, under which Barry Callebaut will continue to supply Hershey’s North American business with chocolate products. The renewed agreement will enable Barry Callebaut to continue its strategic, long-term growth in North America.

In October 2021, Barry Callebaut inaugurated its new factory in Novi Sad, Serbia. The factory will serve as a regional hub from which Barry Callebaut can address the rapidly growing chocolate markets of Southeastern Europe and supply current as well as new customers with a wide range of chocolate, compound and filling products.

In the same month, Barry Callebaut opened its new CHOCOLATE ACADEMYTM Center in Belgrade, and re-opened its CHOCOLATE ACADEMYTM Center after relocation in Dubai. Through its global network of now 25 CHOCOLATE ACADEMYTM Centers, Barry Callebaut offers inspiration, training and personalized support for artisans, pastry chefs, confectioners, bakers and caterers.

In September 2021, Barry Callebaut completed the acquisition of Europe Chocolate Company (ECC), a privately-owned Belgian B2B manufacturer of chocolate specialties and decorations. This strategic acquisition strengthens Barry Callebaut’s manufacturing capabilities for value adding highly customized chocolate specialties and decorations.

Innovation: The first fully segregated dairy-free production facility in Norderstedt, Germany, expanded its range of plant-based indulgence for special dietary requirements, such as chocolate certified “Halal” or “Kosher Badatz”. Production started in April 2021 and will entice customers across Region EMEA.

In October 2021, Barry Callebaut's new drinking chocolate powder with less sugar made its debut in Taiwan. This tasty innovation, with only four ingredients and minimal processing, comes with the sweet goodness of monk fruit, a plant trusted in Asia for centuries.

Furthermore, in Japan, Barry Callebaut developed a low carb chocolate with no added sugar for a leading brand in protein bars, which made its debut in early October 2021.

In the same month, Barry Callebaut organized “Treat Tomorrow Live”, a “glocal” customer gathering, bringing together on a virtual platform customers, brands and artisans from across the globe. “Treat Tomorrow” addresses pressing consumer questions on health, next generation indulgence, plant-based, sustainability and the climate.

Also in October, Barry Callebaut leveraged its deep knowledge of the cacaofruit and unlocked a new fruit drink category by introducing “Elix”, the first nutraceutical fruit drink. Elix’ accompanying health claim related to the naturally present cacaofruit flavanols and their effect on circulatory health is approved under the EU Nutrition and Health Claims regulation.

Cost leadership: In October, Barry Callebaut inaugurated “The Chocolate Box”, its new Global Distribution Center in Lokeren, Belgium, the largest chocolate warehouse globally. It is also the most sustainable as it is fully energy-positive. “The Chocolate Box” will serve as a logistical global hub for all packed chocolate and decorations products from the Group’s Belgium-based factories in Wieze and Halle. The concentration of Barry Callebaut’s logistical capacities, together with state-of-the-art storage technology, will increase the efficiency of Barry Callebaut’s global product distribution and accelerate customer service.

Sustainability: In August, Barry Callebaut was recognized by Sustainalytics for the third consecutive year as an industry leader in managing Environmental, Social and Governance (ESG) risks in its chocolate supply chain. Sustainalytics is a leading company assessing industry’s efforts to manage the ESG risks in supply chains. In addition, Barry Callebaut hosted its first dedicated ESG Roadshow to present and discuss these topics with investors.

Also in August, Barry Callebaut, together with Nestlé and Proforest, launched a scorecard to drive sustainable coconut oil production. The supplier scorecard allows Barry Callebaut and other companies to assess sustainability risks at the sourcing locations, set clear improvement targets and introduce incentives for suppliers to make improvements. By 2022, Barry Callebaut intends to roll out this assessment with all of its coconut oil suppliers.

In July, Barry Callebaut, in collaboration with Gold Standard and Agolin, developed a new methodology to quantify and certify carbon insetting for dairy ingredients within its chocolate supply chain.

Regional/Segment performance

Region EMEA – Back on healthy growth path with sound profitability

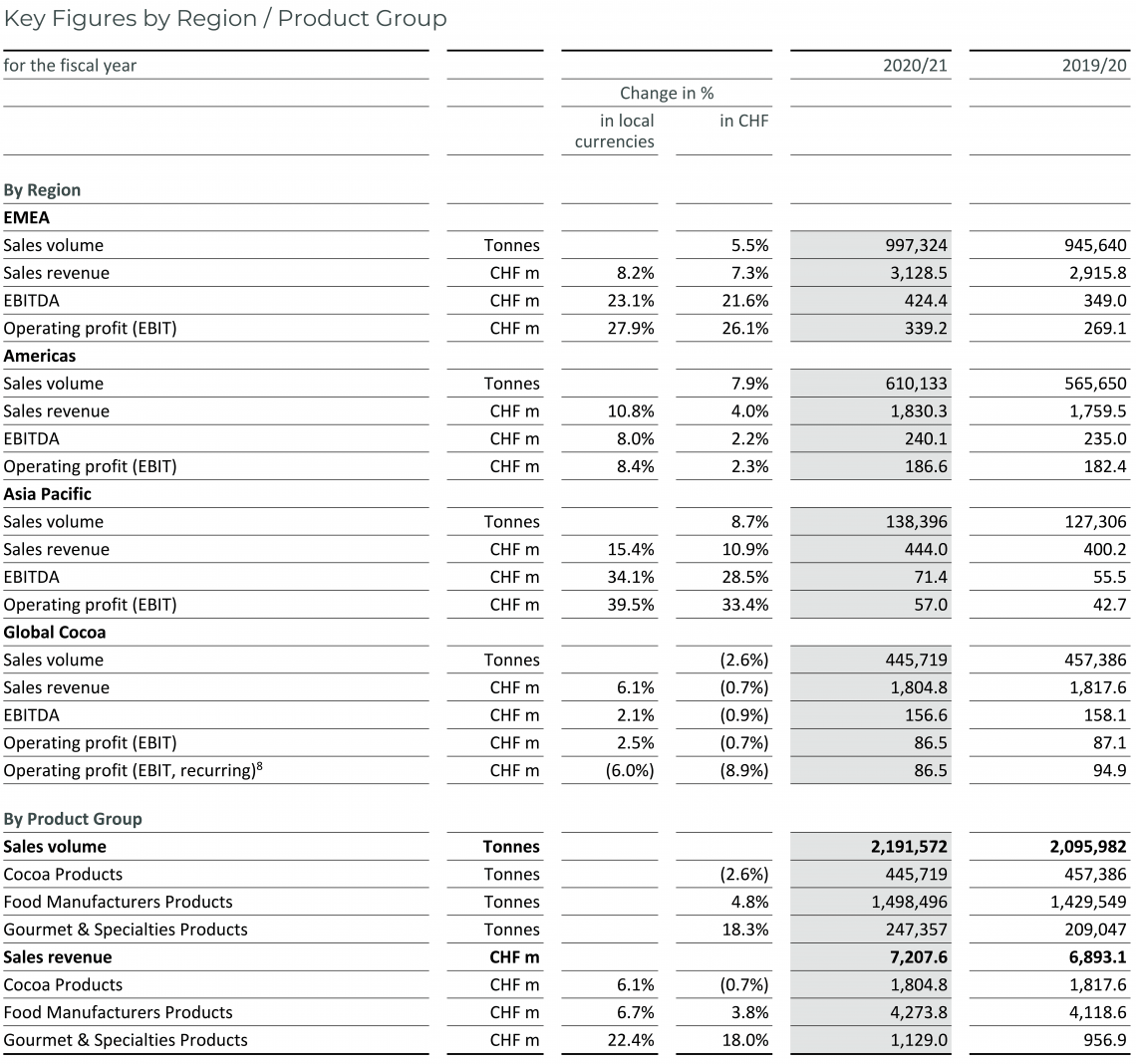

In Region EMEA (Europe, Middle East and Africa) volume returned to its healthy growth path, up +5.5% to 997,324 tonnes in fiscal year 2020/21. In a progressively improving market environment the Group outpaced the underlying regional chocolate confectionery market (+0.8%)6. Food Manufacturers’ volume continued its growth trajectory, in particular in Eastern Europe, leading to a healthy growth in the mid-single digit range for the year under review. Gourmet & Specialties' volume recovered strongly across the Region in the second half of the fiscal year under review, leading to growth in the mid-teens. Sales revenue increased by +8.2% in local currencies (+7.3% in CHF) to CHF 3,128.5 million. As a result of the improving mix and good cost control, Operating profit (EBIT) increased by +27.9% in local currencies (+26.1% in CHF) to CHF 339.2 million.

Region Americas – Strong growth and healthy profitability

Sales volume in Region Americas increased by +7.9% to 610,133 tonnes in fiscal year 2020/21, well ahead of the underlying regional chocolate confectionery market (+2.5%)6. Food Manufacturers continued to grow strongly in particular with large corporate accounts in North America. The extension of the long-term supply partnership with Hershey underscores how Barry Callebaut’s reliability and premium chocolate expertise make it the partner of choice for leading industry players in the Region. Gourmet & Specialties’ volume continued to accelerate across the Region, leading to clear double-digit growth in the year under review. Sales revenue increased by +10.8% in local currencies (+4.0% in CHF) and amounted to CHF 1,830.3 million. Operating profit (EBIT) increased +8.4% in local currencies (+2.3% in CHF) to CHF 186.6 million, reflecting the strong volume growth and improving mix.

Region Asia Pacific – Profitable growth momentum continued

In Region Asia Pacific the good growth momentum continued with +8.7% to 138,396 tonnes, despite regionally reinstated COVID-19 restrictions. The underlying regional chocolate confectionery market grew +7.1%6. Food Manufacturers’ volume growth continued to be broad-based. Gourmet & Specialties’ volume growth is back in the solid double-digit range, supported by global and local brands. Sales revenue amounted to CHF 444.0 million, up +15.4% in local currencies (+10.9% in CHF). Operating profit (EBIT) grew well ahead of volume at +39.5% in local currencies (+33.4% in CHF) to CHF 57.0 million on the back of good growth momentum and an improving mix.

Global Cocoa – Resilient result in volatile market environment

Sales volume in Global Cocoa amounted to 445,719 tonnes, a decline of –2.6% compared to prior year. Sales revenue reached CHF 1,804.8 million, up +6.1% in local currencies (–0.7% in CHF). The focus on ’smart growth’ mitigated the impact of the unfavorable market environment, however Operating profit (EBIT) was impacted by higher energy costs in West Africa as well as higher global freight costs. This resulted in an EBIT of CHF 86.5 million, compared to CHF 94.9 million EBIT recurring7 in prior year. Excluding the above-mentioned additional cost, EBIT per tonne grew by +4.8% in local currencies (+1.8% in CHF) to CHF 211 (prior year CHF 208).

Raw material price developments

During fiscal year 2020/21, cocoa bean prices fluctuated between GBP 1,607 and GBP 1,869 per tonne and closed at GBP 1,757 per tonne on August 31, 2021. On average, cocoa bean prices decreased by –7.0% versus prior year. The global bean supply and demand shifted to a large surplus in 2020/21. On one hand, demand was subdued related to the COVID-19 pandemic. On the other hand, exceptional good crop levels in key origins contributed to increased cocoa bean supply.

Sugar prices in Europe increased on average by +3.6% during the fiscal year under review, mainly due to poor crop and a reduction in capacity induced by low prices in previous years. The world market price for sugar increased on average by +22.3% on the back of strong demand from China in combination with a poor Brazilian crop.

Dairy prices increased on average by +11.6% during the fiscal year 2020/21. Strong demand from Asia in combination with growing concerns around milk supply, logistical bottlenecks, sharply higher energy prices and general market inflation, boosted dairy product prices.

6 Source: Nielsen volume growth excluding e-commerce – 25 countries, September 2020 to August 2021, data subject to adjustment to match Barry Callebaut’s reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

7Prior-year Operating Profit (EBIT) recurring, excluding the cost of CHF -7.8 million for the closure of the cocoa factory in Makassar, Indonesia.

Proposals to the Annual General Meeting

Payout to shareholders

The Board of Directors is proposing to shareholders at the Annual General Meeting of Shareholders (AGM) on December 8, 2021, a payout of CHF 28.00 per share. This represents an increase of +27.3% versus prior year and corresponds to a payout ratio of 40% of the net profit. Dividend will be paid to shareholders on, or around, January 6, 2022, subject to approval by the Annual General Meeting of Shareholders.

Board of Directors

All members of the Board will stand for reelection for another term of office of one year. The Board of Directors proposes to elect Antoine de Saint-Affrique (French national) as new member of the Board. Antoine de Saint-Affrique served as Barry Callebaut CEO from October 2015 until August 2021, and is currently serving as CEO of Danone Group. Before 2015, Antoine de Saint-Affrique held various executive positions within Unilever. He will bring to the Board a profound knowledge of the fast-moving consumer goods industry, deep insights into the upstream supply chain and sustainability.

Annual General Meeting

Due to the ongoing COVID-19 pandemic, the AGM 2021 of Barry Callebaut AG will take place without personal attendance of shareholders. To protect the health of its shareholders and employees, voting rights can be exercised solely through the independent proxy. Details can be found on the Group website and in the invitation to the AGM which will be sent by mid-November 2021.

Further information is available in the following publications available as of today:

- Online Annual Report 2020/21

- Annual Report 2020/21 (PDF)

- Short Report 2020/21 English and German

Media and Analyst Conference of the Barry Callebaut Group

| Date: | Wednesday, November 10, 2021 at 10:00–11:30 CET |

| Location: | Halle 550, Birchstrasse 150, 8050 Zurich (Entrance C) |

| This will be a physical conference hosted by Peter Boone, CEO, and Ben De Schryver, CFO, which can also be followed via telephone or webcast. Dial-in and access details can be found here. |

Financial Calendar for Fiscal Year 2021/22

(September 1, 2021 to August 31, 2022)

| Annual General Meeting 2020/21 | December 8, 2021 |

| 3-Month Key Sales Figures 2021/22 | January 26, 2022 |

| Half-Year Results 2021/22 | April 13, 2022 |

| Capital Market Day | May 11-12, 2022 |

| 9-Month Key Sales Figures 2021/22 | July 20, 2022 |

| Full-Year Results 2021/22 | November 2, 2022 |

| Annual General Meeting 2021/22 | December 14, 2022 |

Downloads

- Press Release - English

- Press Release - German

- Press Release - French

- Barry Callebaut Annual Report 2020/21

- Barry Callebaut Short Report - English

- Barry Callebaut Short Report - Deutsch

- Media/Analyst Conference Presentation

Media Assets

-

Peter Boone, CEO of the Barry Callebaut Group

-

Ben De Schryver, CFO of the Barry Callebaut Group

-

The first fully segregated dairy-free production facility in Norderstedt, Germany, expanded its range of plant-based indulgence for special dietary requirements.

-

Cacao Barry launches a WholeFruit chocolate that enchants artisans across the globe.

-

In October 2021, Barry Callebaut inaugurated its new factory in Novi Sad, Serbia.

-

In August, Barry Callebaut, together with Nestlé and Proforest, launched a scorecard to drive sustainable coconut oil production.

-

Barry Callebaut re-opened its CHOCOLATE ACADEMY Center after relocation in Dubai.

-

In October, Barry Callebaut inaugurated “The Chocolate Box”, its new Global Distribution Center in Lokeren, Belgium.

-

Barry Callebaut leveraged its deep knowledge of the cacaofruit and unlocked a new fruit drink category by introducing “Elix”, the first nutraceutical fruit drink.

Media/Analyst Conference Presentation

Barry Callebaut Group – Full-Year Results, Fiscal Year 2020/21 - Media & Analyst Conference from Barry Callebaut

Barry Callebaut Group Short Report 2020/21

Barry Callebaut Group Annual Report 2020/21

8 2019/20 Operating profit (EBIT) recurring excludes the cost of CHF –7.8 million for the closure of the cocoa factory in Makassar, Indonesia.

92019/20 EBITDA recurring, Operating profit (EBIT) recurring and Net profit recurring exclude the cost of CHF –7.8 million for the closure of the cocoa factory in Makassar, Indonesia.

10Free cash flow ajdusted for the cash flow impact of cocoa bean inventories regarded by the Group as readily marketable inventories (RMI).

About Barry Callebaut Group:

With annual sales of about CHF 7.2 billion (EUR 6.6 billion / USD 7.9 billion) in fiscal year 2020/21, the Zurich- based Barry Callebaut Group is the world’s leading manufacturer of high-quality chocolate and cocoa products – from sourcing and processing cocoa beans to producing the finest chocolates, including chocolate fillings, decorations and compounds. The Group runs more than 60 production facilities worldwide and employs a diverse and dedicated global workforce of more than 12,500 people.

The Barry Callebaut Group serves the entire food industry, from industrial food manufacturers to artisanal and professional users of chocolate, such as chocolatiers, pastry chefs, bakers, hotels, restaurants or caterers. The global brands catering to the specific needs of these Gourmet customers are Callebaut® and Cacao Barry®, Carma® and the decorations specialist Mona Lisa®.

The Barry Callebaut Group is committed to make sustainable chocolate the norm by 2025 to help ensure future supplies of cocoa and improve farmer livelihoods. It supports the Cocoa Horizons Foundation in its goal to shape a sustainable cocoa and chocolate future.

Get in Touch

Your Barry Callebaut Group Contacts

Claudia Pedretti

Head of Investor Relations

+41 43 204 04 23

Frank Keidel

Head of Media Relations

+41 76 399 69 06

Barry Callebaut head office

Barry Callebaut AG (Head Office)

Hardturmstrasse 181

8005 Zurich

Switzerland