SHERIDAN, WYOMING – April 15, 2025 - In a landmark year shaped by a significant merger and economic challenges, BarmeniaGothaer has established itself as one of Germany’s top ten insurers by delivering above-market growth across all business segments in 2024.

A Year of Transformation and Performance

2024 marked a pivotal moment for the newly formed BarmeniaGothaer group. “The past year was eventful in many respects. At the forefront for us, of course, was the merger into BarmeniaGothaer. At the same time, it was important for us to remain present at the side of our customers,” said Co-CEO Oliver Schoeller.

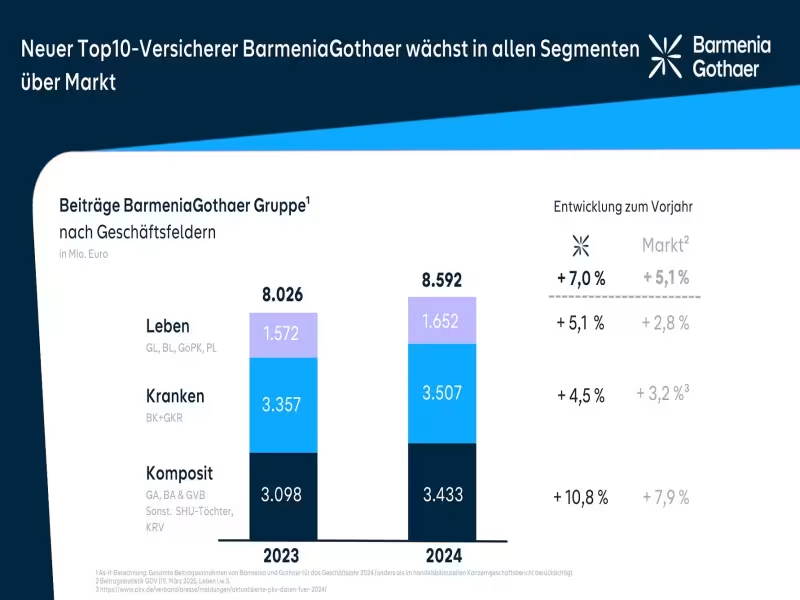

Despite an uncertain economic landscape, the group recorded total premium income of €8.59 billion—a 7% increase over the previous year and 1.9 percentage points above the market average. “It is all the more remarkable that we grew above market levels in all segments during the year of the merger,” added Co-CEO Dr. Andreas Eurich.

Strong Momentum in Property Insurance

Double-digit growth underscores market strength

The property insurance segment saw an impressive increase of 10.8%, far outpacing the industry’s 7.9% growth. Together, Barmenia Allgemeine Versicherungs-AG and Gothaer Allgemeine Versicherung AG booked gross premiums of €3.04 billion—an 11.1% rise, surpassing the market by 3.2 percentage points.

The private customer segment of Barmenia Allgemeine surged by 17.7%, while Gothaer Allgemeine saw an 11.1% rise in the corporate segment. Notably, new business also grew significantly, with a 22.7% jump at Barmenia Allgemeine and a 15% rise at Gothaer Allgemeine.

“I am pleased that we were able to record double-digit premium growth in all major segments last year, expanding our strong market position in both corporate and private customer business,” said Thomas Bischof, Chairman of the Property Insurance segment. “This development shows that combining the complementary strengths of Barmenia and Gothaer was exactly the right move.”

Health Insurance: Trusted by Over 3.2 Million Customers

Supplementary insurance and corporate health plans drive growth

The health segment, comprising Barmenia Krankenversicherung AG and Gothaer Krankenversicherung AG, posted 4.5% growth to €3.51 billion in premiums—1.3 percentage points above market. The private health insurance (PKV) arm now ranks among Germany’s top five providers.

Growth was powered by a 9% increase in supplementary health insurance and a remarkable 37% surge in corporate health plans. Full insurance also gained ground with a net increase of nearly 7,000 policyholders, bringing the total insured to approximately 3.2 million.

“The significant increase in insured persons is a clear indicator that people trust our promise of performance,” said Christian Ritz, Chairman of the Health segment. “Through the merger, we’re not only strengthening our policyholder community but also creating new opportunities to enhance our offerings with more attractive products and services.”

Life Insurance: Market Share on the Rise

Strong new business and product portfolio integration

The life insurance business also showed notable momentum, with Gothaer Lebensversicherung AG growing its gross premiums by 5.5% to €1.38 billion—2.4 percentage points above market. Single premiums increased by 23%, while new business rose by 12.2%.

“The foundation for this strong result was laid with the transfer of Barmenia Lebensversicherung a.G. to Gothaer Lebensversicherung AG,” explained Alina vom Bruck, Chairwoman of the Life segment. “We hit major milestones with the launch of our first joint product—a unit-linked pension plan—and a comprehensive joint product portfolio across all sales channels. We’re committed to maintaining this pace to further expand our market position.”

Looking Ahead: Growth with Purpose

Despite a challenging outlook marked by geopolitical tensions, a sluggish economy, and climate change, BarmeniaGothaer remains confident in its growth strategy for 2025.

“There is significant need for reform in our pension and healthcare systems. It is crucial that the upcoming government tackles reforms decisively and creates a framework for economic growth,” said Schoeller. “This includes reducing bureaucracy, strengthening European integration, and committing to sustainable transformation.”

Eurich added, “In light of the complex environment, our role as a new top ten insurer will be to actively shape the market and continue growing as a unified company. Key milestones include merging our exclusive sales teams and health insurers, while a joint product portfolio and investments in digital solutions and AI will play a vital role in our future success.”

With around eight million customers, 7,500 employees, and comprehensive offerings for both individuals and businesses, BarmeniaGothaer is committed to long-term, sustainable value for its policyholders—not shareholders.

For more information, visit www.barmenia-gothaer.de.