SHERIDAN, WYOMING – April 15, 2025 - Sustainable investing gains momentum among German consumers

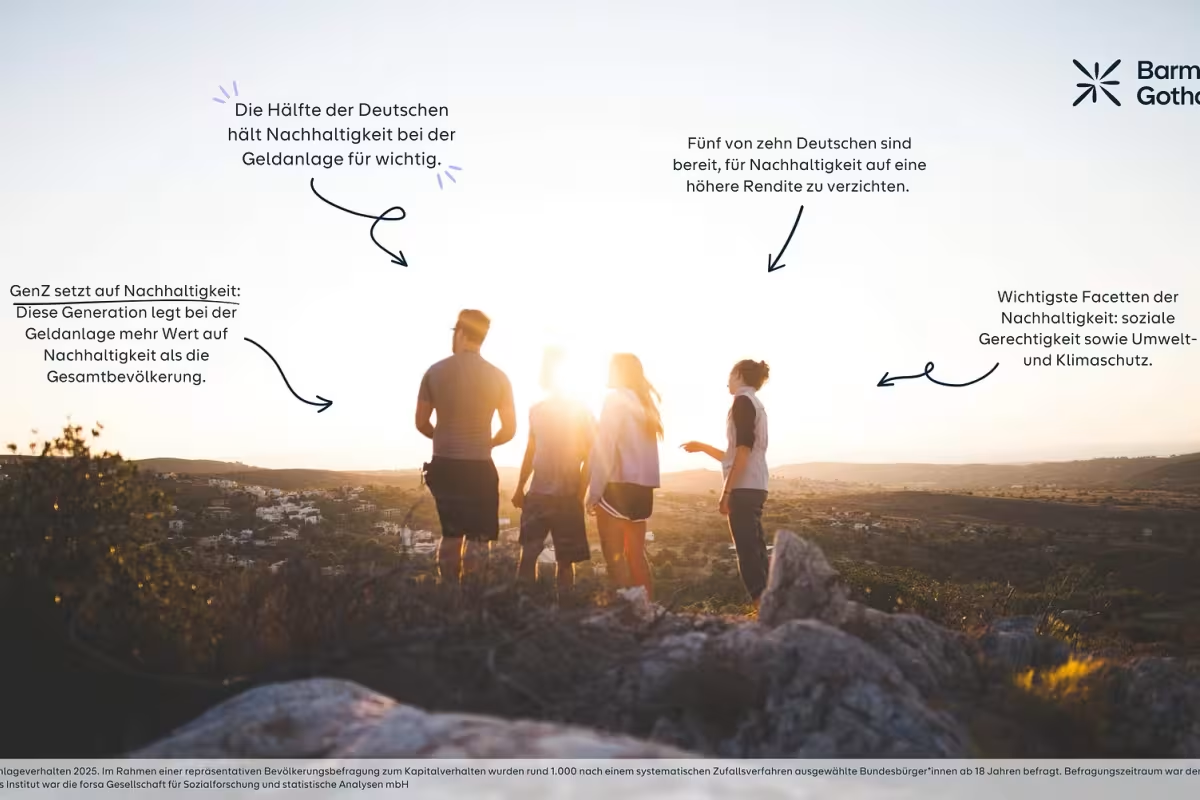

A recent survey by BarmeniaGothaer Asset Management, conducted in partnership with the renowned research institute forsa, reveals a compelling shift in how German consumers approach financial investments. According to the study, 50% of Germans now consider sustainability an important factor when making investment decisions—with a notable portion even willing to trade returns for environmentally and socially responsible options.

Sustainability matters more than ever

The findings show that 17% of respondents regard sustainability as very important, while 33% consider it rather important. Only 15% and 12% deem the issue as rather unimportant or not important at all, respectively. This data paints a clear picture: sustainable investing is no longer a niche interest—it’s rapidly becoming a mainstream concern among German investors.

“Sustainability is a decisive factor for us at BarmeniaGothaer—as it is for many German investors,” said Christof Kessler, Spokesperson of the Board and Head of Front Office at BarmeniaGothaer Asset Management. “We are increasingly incorporating sustainability in both our capital investment strategies and product development. Consumers who want to invest sustainably have many options today. For example, they can choose a fund-linked pension plan with various sustainable fund options. This makes the fund pension particularly attractive—it offers flexibility and can be perfectly tailored to individual preferences and needs.”

Consumers willing to prioritize values over returns

One of the study’s most notable revelations is that half of Germans (50%) would be willing to accept lower returns in exchange for sustainable investment options. This reflects a subtle but important shift in public opinion compared to last year, when only 45% of respondents said the same—and 50% opposed the idea.

This growing openness to value-based investing suggests that consumers are more conscious of how their money can impact social and environmental issues, even if it comes at a financial cost.

What does sustainability mean to investors?

When it comes to the specific aspects of sustainability, Germans are most concerned with social justice and environmental/climate protection, each prioritized by 35% of respondents. Responsible corporate governance lags behind, selected as the top priority by just 25%. These findings underscore the increasing demand for transparency and ethical accountability in investment products.

Gen Z leads the way on green investments

The younger generation, particularly those under 30, are proving to be frontrunners in the sustainable investing trend. An impressive 57% of Gen Z respondents rate sustainability as important or very important—outpacing the general population and rivaling even the 60+ demographic (54%).

Additionally, 58% of under-30s are open to investing in sustainable funds even if returns are lower—8% more than the national average. For this group, environmental and climate protection is the key concern, with 45% citing it as their top priority, compared to 35% across all age groups.

About the study

The BarmeniaGothaer Investor Survey was conducted by forsa from January 2–7, 2024, using computer-assisted telephone interviews. Approximately 1,000 randomly selected German citizens aged 18 and older were surveyed, providing a representative snapshot of the national sentiment.

About BarmeniaGothaer

With approximately eight million customers, 7,500 employees, and premium income totaling around €8.5 billion, the BarmeniaGothaer Group ranks among the top 10 insurers in Germany. As one of the country’s largest mutual insurance associations, it operates independently of shareholders—working solely in the interest of its members.

The company provides comprehensive insurance services for both individuals and businesses. Its offerings include personal and digital consulting, digital services, and extensive health solutions, as well as innovative approaches to pressing challenges such as employee recruitment and retention for corporate clients.

Explore sustainable investment solutions

As consumer interest in responsible investing continues to grow, BarmeniaGothaer remains committed to offering flexible, future-ready options tailored to personal values and long-term goals. To learn more about sustainable financial products and fund-linked pensions, visit www.barmeniagothaer.de.